Across Africa, the need to send, receive, and store money is universal, but the methods couldn’t be more different. At LOOKA, we’ve observed that while the need to manage money is universal across Africa, the way people do it varies dramatically. Through our experience in fintech onboarding strategies in countries like Nigeria and a recent survey of 600 participants (18 and above) in Kenya and South Africa, we have identified a significant gap in user behavior. This article aims to highlight these differences and provide a clear roadmap for what fintechs need to do to succeed in South Africa. We will compare how payment habits play out between Kenya and Nigeria, the world's first leading mobile money pioneers and South Africa.

Kenya and Nigeria Mobile First Leaders

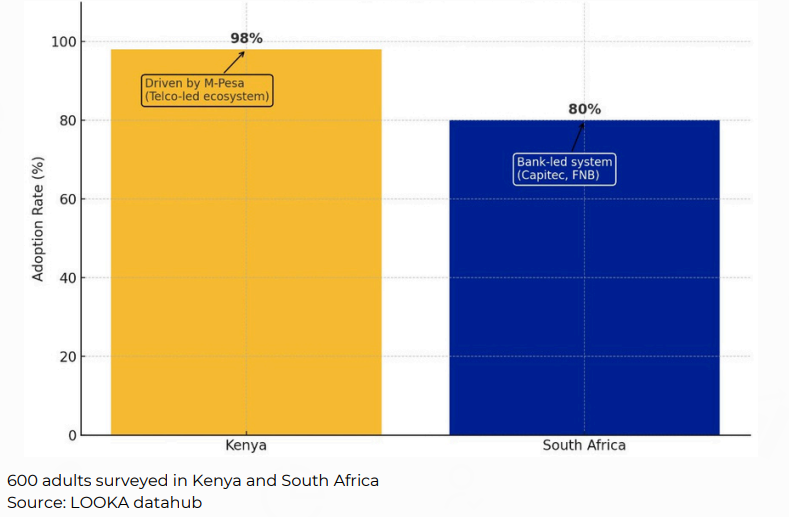

In Kenya, mobile money isn’t just an option nowadays, it’s the default. M-Pesa, launched in 2007, revolutionized how people handle money, reaching near-universal penetration (about 98%). For millions, the phone became the primary wallet, used for everything from buying groceries to paying school fees. This happened largely because mobile networks moved faster than banks, filling a gap before traditional finance could dominate.

Nigeria’s journey took another route. For decades, informal cash transfers were the norm. But rapid urbanization, a booming fintech sector, and a young, tech-savvy population have driven an aggressive shift toward digital wallets and payment apps. Today, urban Nigerians are sending money, paying bills, and shopping online with the same ease they once reserved for cash transactions, making the country one of Africa’s fastest-growing fintech hubs. But what about South Africa?

South Africa With A Different Story

At first glance, South Africa might seem primed for the same mobile money dominance. Over 80% of the population uses some form of it. But beneath the surface, daily payments still lean heavily on cash and bank cards. The difference lies in the foundations.

While Kenya and Nigeria’s payment revolutions were born from necessity, South Africa entered the digital age with a robust, formal banking system already in place. Debit and credit cards had long been entrenched in everyday life, and bank branches were widespread even in smaller towns. Mobile money, therefore, didn’t arrive as a replacement for a missing system, but it arrived as an add-on.

Why South Africans Pay Differently

From the survey results, several key factors shape this contrast:

- Banking Legacy – Established banks built South Africa’s payment infrastructure decades before mobile wallets arrived. This made card payments second nature, unlike in Kenya where telcos led the way.

- The Trust Gap – About 37% of South Africans express doubts about digital payments. These concerns aren’t about awareness, they are about reliability. Unlike in Kenya, where M-Pesa’s decade-long reliability has bred confidence, South African adoption is slowed by caution.

- Everyday Payment Patterns – Cards and cash dominate retail purchases, accounting for 45% and 46% of transactions respectively. Mobile money? Just 8%. Compare that to Kenya, where mobile money accounts for more than half of retail payments.

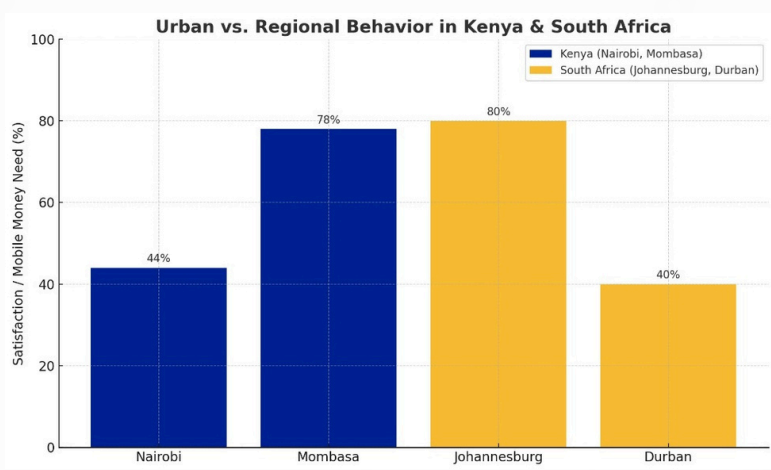

- Regional and Gender Nuances – Urban users show different appetites for mobile payments. In South Africa, Johannesburg outpaces Durban in urgency for adoption. Gender adds another layer, for example, Kenyan women tend to rely more on cash, whereas South African women gravitate toward using savings groups and mobile service.

- Domestic vs. Cross-Border Flows – In South Africa, payment flows are largely domestic, moving between provinces rather than countries. Ethiopia, for example, sees their P2P flows heavily shaped by cross-border remittances from the diaspora, which often rival or exceed domestic transactions in value.

Money habits aren’t just about technology, they’re about culture and trust. In Kenya and Nigeria, mobile payments are often tied to convenience, speed, and necessity. In South Africa, payments remain deeply social and physical, whether it’s swiping a card at the grocery store or handing over cash at the market.

For many, the reassurance of a tangible payment method outweighs the convenience of an app. It’s not that South Africans can’t go mobile; it’s that their system doesn’t demand it in the same way.

The Opportunity for Fintech Innovators

South Africa’s payment market is evolving, but not in the same rush as Kenya or Nigeria. For fintechs, this slower pace is not a roadblock, it’s a space to build better, more tailored solutions. To win here, innovators need to:

- Close the Trust Gap – Showcase consistent reliability and back it with responsive, human customer service.

- Design for Habits – Make digital tools feel as fast, familiar, and tangible as swiping a card or handing over cash.

- Respect the Nuance – Tailor products to regional and gender-specific needs, instead of assuming a one-size-fits-all model.

South Africa isn’t leaping ahead like Kenya, sprinting into experimentation like Nigeria, or riding a remittance-driven P2P wave like Ethiopia. Instead, it’s layering digital options on top of a strong, card-based foundation. This means mobile money adoption will likely grow steadily, but only when it can match the trust, familiarity, and ease that South Africans already enjoy. For fintechs willing to adapt, the reward is huge . The chance to design payment solutions that don’t just work, but seamlessly fit into the rhythm of South African life. We conduct in-depth studies like this to uncover such insights, to explore more, visit our website.